Thank you for your support at RList Insights all these years!

We are migrating our robotics-related content to apera.io, a platform (beta) which helps you discover companies & products in robotics, AI, IoT, metaverses & other emerging tech. Visit our new home!

You can also find a related article Robot-as-a-Service (RaaS) Business Models in the Market Today (2022 edition) at https://apera.io/p/robot-as-a-service-raas-business-models-in-the-mar.

We are migrating our robotics-related content to apera.io, a platform (beta) which helps you discover companies & products in robotics, AI, IoT, metaverses & other emerging tech. Visit our new home!

You can also find a related article Robot-as-a-Service (RaaS) Business Models in the Market Today (2022 edition) at https://apera.io/p/robot-as-a-service-raas-business-models-in-the-mar.

Brave, New World of Robots-as-a-Service

Image credit: TechObjects.io

Image credit: TechObjects.io

Robot as a service (RaaS) is fast becoming a necessary de facto offering for robotics companies, particularly in industries that are traditionally labor-dependent and sensitive to minimal labor wages. These industries include the cleaning services, safety and security services, delivery services, logistics and warehouse operations, and manufacturing operations.

In this year-end report for 2020, we look at the state of robot-as-a-service markets as well as the up-and-coming players, with the following content structure (10-minute read):

In a nutshell, what is Robot-as-a-Service?

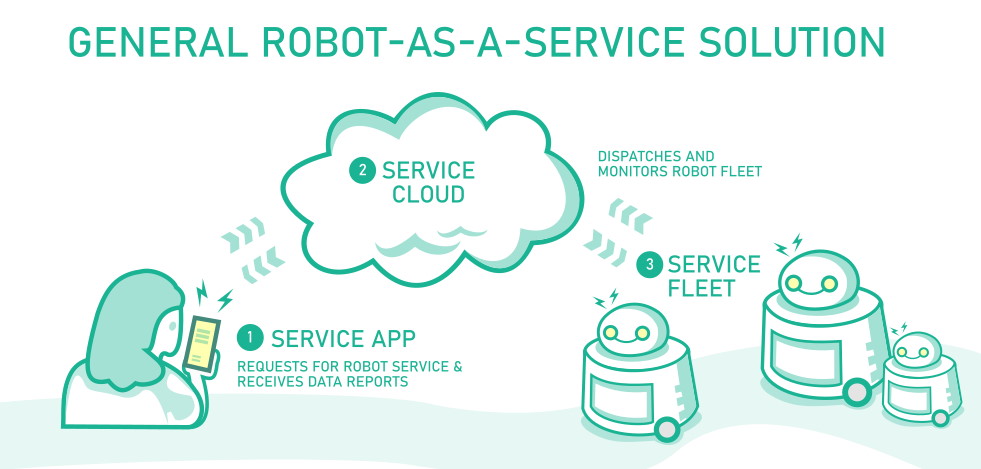

A complete robot-as-a-service solution goes beyond the simple leasing of industrial or service robotic hardware. It offers users continuous value while charging users based on what they use or need. The continuous value generation comes from the combination of a service app, a service cloud and a generally available fleet of robots that can be deployed as-needed.

General Robot-as-a-Service Solution

Image credit: TechObjects.io

Image credit: TechObjects.io

Users access the service app, either on web browsers or mobile devices or both, to request for robotic services and obtain data reports on their usage. The service cloud acts as a co-ordination center for monitoring the general availability of robotic resources and for scheduling, dispatching and instructing robots to their tasks and locations. Under a RaaS service level agreement (SLA), it is the responsibility of the service provider to maintain and ensure the operational readiness and uptime of the robotic fleet.

How users benefit from Robot-as-a-Service offerings

Under the Robot-as-a-Service model, customers do not need to make upfront investments to purchase the robots and maintain them as assets that incur maintenance costs and depreciate over time. Instead, they purchase robotic services from RaaS companies and are billed on a recurring basis, based on usage, time or other metrics.

The benefits to the customers are tremendous:

Why robotic companies pursue the Robot-as-a-Service model

One example of a RaaS provider is Avidbots, which provides its floor-scrubbing Neo service robots at US$4-6 per hour (source).

For robotics companies, RaaS reduces friction in the sales justification process and enables them to have a clear, sharp and compelling edge over traditional robotics company that require customers to make hefty upfront purchases. In addition, customers that have accepted and deployed the RaaS solution are generally less willing to switch to another robotics service provider, thus enabling robotics companies to strengthen their market share.

But can they really afford it?

Geek+ Robotics is an example of a RaaS provider that has expanded its fleet and operations rapidly in the warehouse and logistics market, with more than 7000 robots worldwide across over 200 projects. (source).

Should every robotic company start rushing out a RaaS offering now? Not so fast - in the RaaS model, the downside is that the hefty, upfront costs of building up a robotic fleet (and risks of maintaining the fleet) are transferred from the customers to the robotics companies. Robotics companies intending to start a RaaS offering must ask these hard questions:

For more insights, read our other report on 2020 Robot-as-a-Service Business Models and Monetization.

In the next page, we continue to explore who and where are the RaaS Players today.